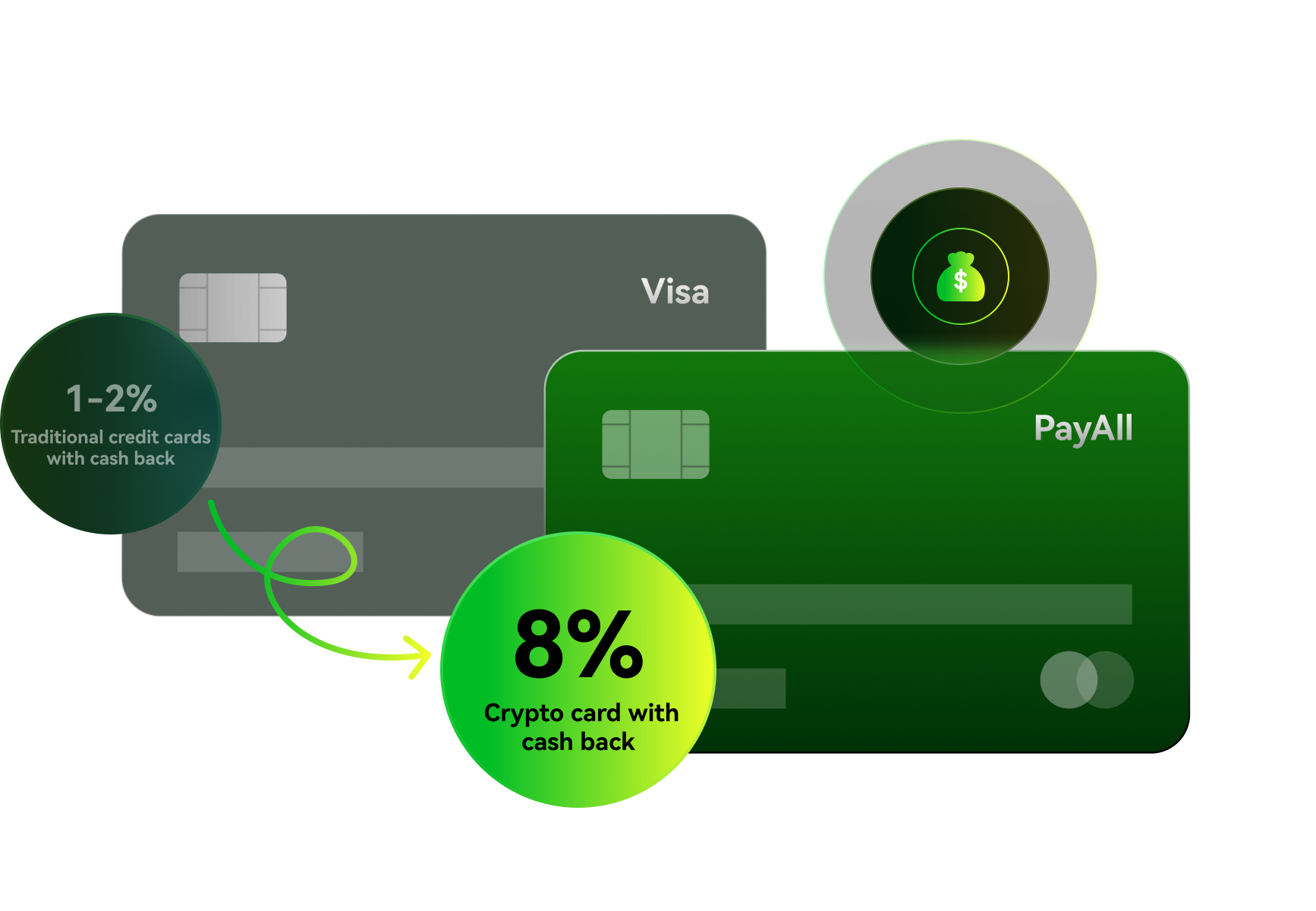

Turn your digital assets into purchasing power at 40+ million merchants worldwide

Keep transactions separate from traditional banking systems

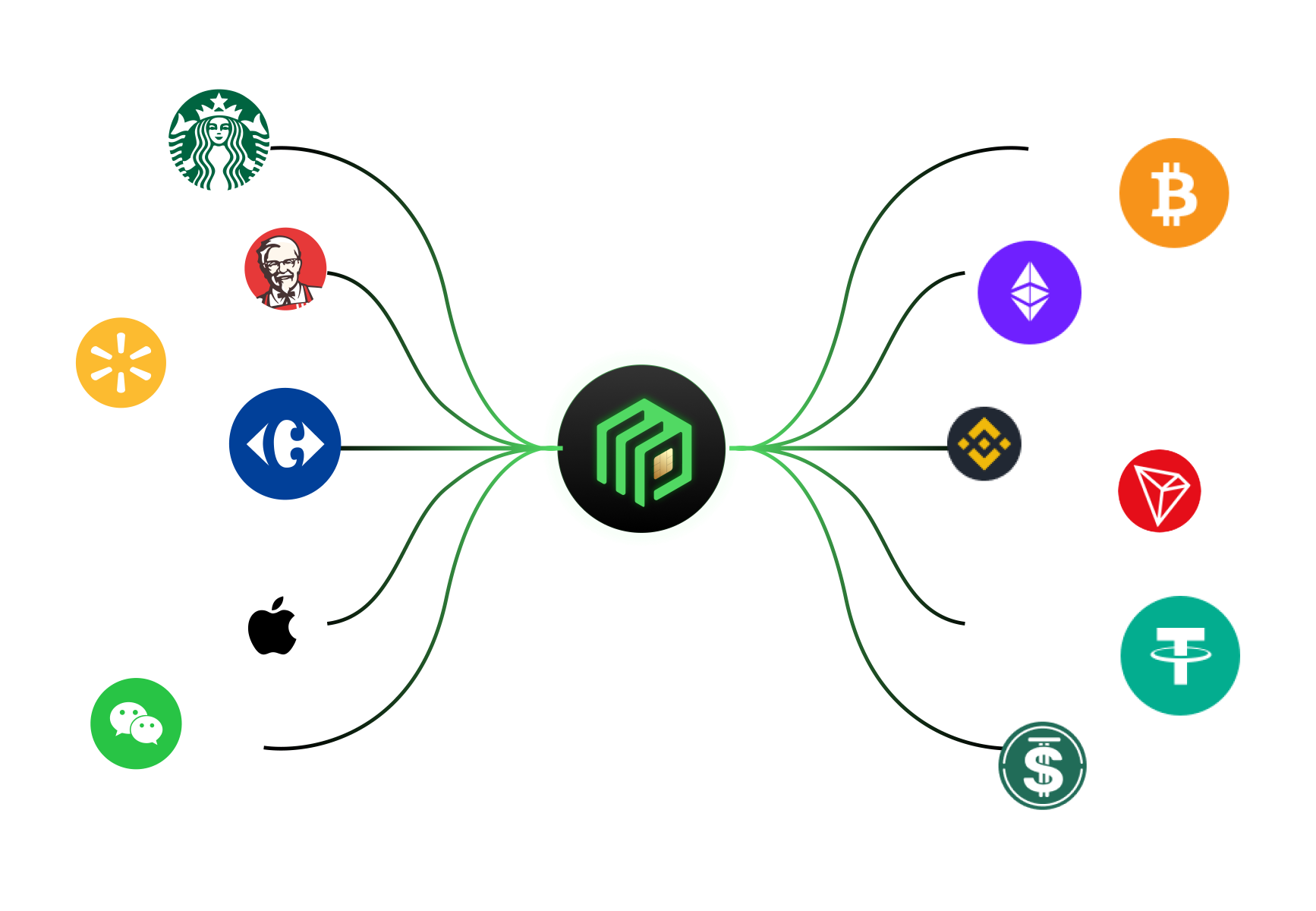

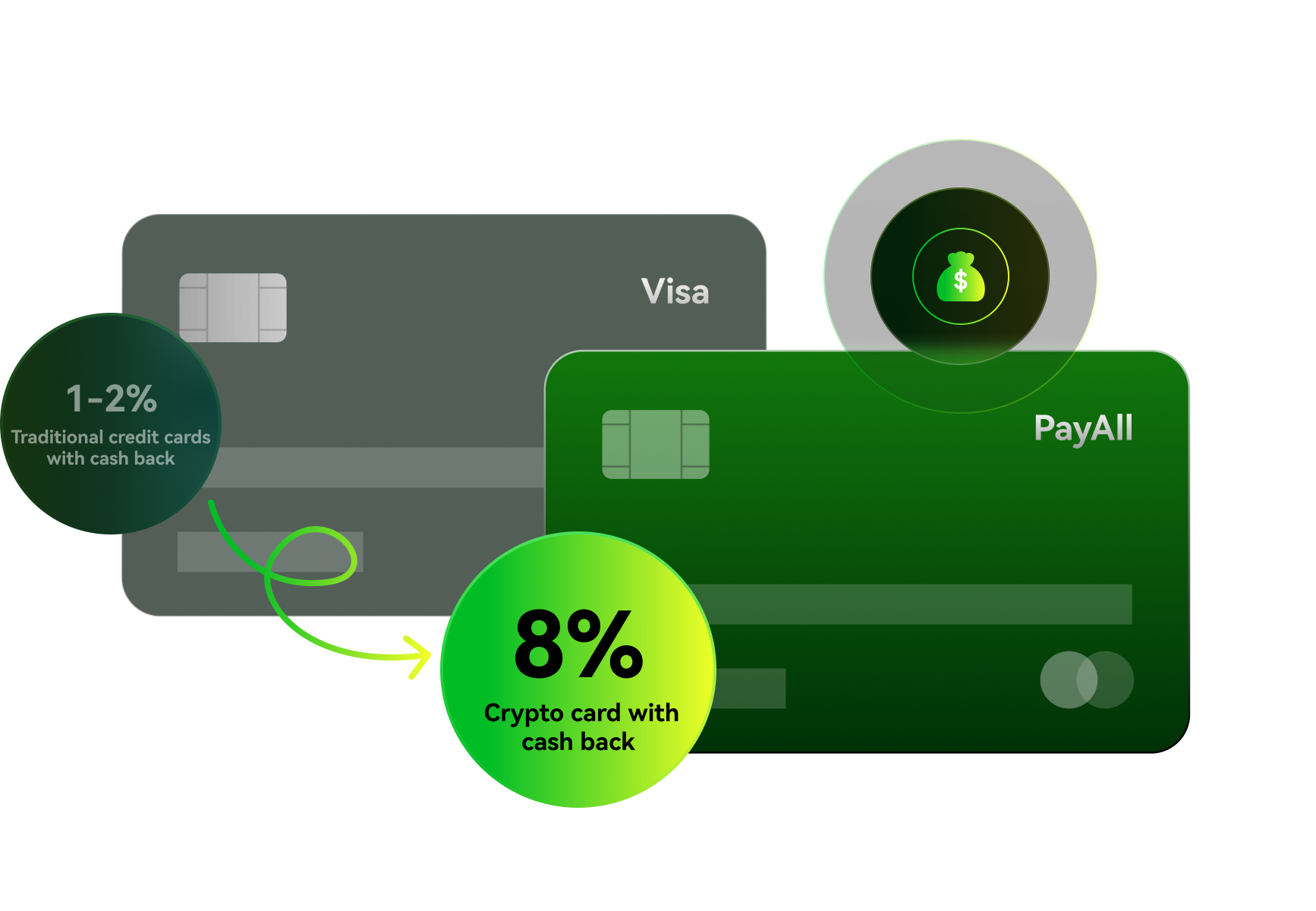

Earn up to 8% cashback in crypto, crushing the 1-2% from traditional cards, and bypass costly exchange transfers

One-stop deposits cover BTC, ETH, USDT and other cryptocurrencies, as well as various fiat channels; one-click withdrawals to bank accounts or on-chain addresses, simplifying the entire process.

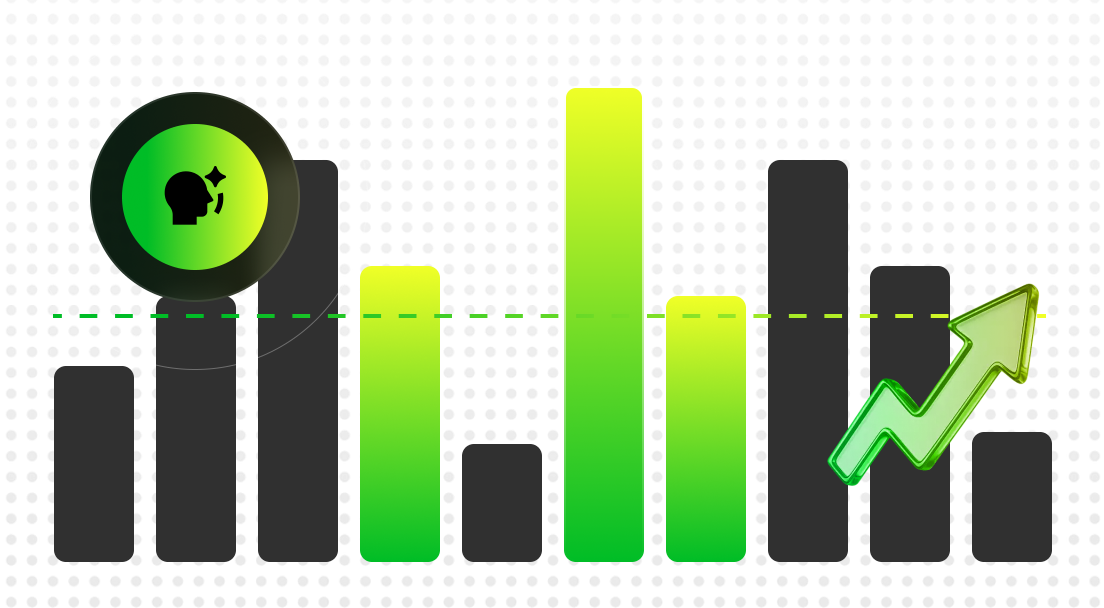

Get personalized card suggestions based on your spending habits, financial goals, and transaction context—ensuring you always use the most suitable card for your needs

Identify highest cashback rates per merchant category

Avoid unnecessary transaction fees

Spot limited-time promotions

Evaluate perks like lounge access, insurance, and purchase protection

Carry multiple cards, use one app. PayAll makes the decision in milliseconds, turning your decision into a seamless tap

Our AI agents process thousands of data points—merchant codes, reward structures, fee schedules—delivering recommendations based on hard numbers, not hunches

PayAll learns your patterns and preferences to sharpen recommendations over time. Your data remains encrypted locally—we see trends, not transactions

Card benefits change constantly. PayAll tracks rate updates, new card launches, and promotional periods across the entire crypto card ecosystem

All your data stays encrypted on your local device.Zero server-side storage of personal information.Complete transaction anonymity.

Before every trip abroad I used to wonder which card saves the most; now I just want PayAll to automatically tell me.

There are too many cashback cards and the fee rules are confusing; I really need a tool to compare them for me.

I want a card that doesn’t require KYC but still works—an aggregation platform like PayAll is exactly what I need.

Opening, selecting, and comparing cashback cards is too much hassle; I hope PayAll really does it with one click.

Sometimes having too many cards makes them hard to use; I look forward to PayAll telling me which one to use.

There are too many tokens and chains—I don’t know which cards accept which; it’d be great if PayAll could auto-identify them.

Now I have to calculate fees myself before spending; having an AI help me choose is so much more reassuring.

No product on the market truly helps me compare cards—PayAll is the first heading in the right direction.

Stop making me switch cards, trial and error, and miss opportunities—PayAll, launch now!

The “auto-recommend the optimal card” feature alone makes me want to start using it immediately.

Before every trip abroad I used to wonder which card saves the most; now I just want PayAll to automatically tell me.

There are too many cashback cards and the fee rules are confusing; I really need a tool to compare them for me.

I want a card that doesn’t require KYC but still works—an aggregation platform like PayAll is exactly what I need.

Opening, selecting, and comparing cashback cards is too much hassle; I hope PayAll really does it with one click.

Sometimes having too many cards makes them hard to use; I look forward to PayAll telling me which one to use.

There are too many tokens and chains—I don’t know which cards accept which; it’d be great if PayAll could auto-identify them.

Now I have to calculate fees myself before spending; having an AI help me choose is so much more reassuring.

No product on the market truly helps me compare cards—PayAll is the first heading in the right direction.

Stop making me switch cards, trial and error, and miss opportunities—PayAll, launch now!

The “auto-recommend the optimal card” feature alone makes me want to start using it immediately.